This is a sponsored post written by me on behalf of E*TRADE for IZEA. All opinions are 100% mine.

Saying yes was easy when I was given the opportunity to write a piece related to E*TRADE because I moved my small business’ Individual 401(k) to the firm not that long ago.

The reason why I moved the accounts over were three folds. First, they were offering a cash incentive to transfer my assets over, which was essentially free money. Second, there was a quirk with my original small business 401(k) where we were charged higher fees for the same investment, so moving to another firm automatically meant paying less investment fees. Third, E*TRADE allowed me to move all my previous pre-tax IRA money into a 401(k), simplifying management and allowing for a backdoor Roth maneuver without paying taxes prematurely.

And for those who don’t know, backdoor Roth is for tax payers who hit the income limitation and therefore don’t qualify to make a Roth contribution. To get around that, an individual could make a non-deductible contribution to a Traditional IRA account, and then immediately convert that amount to a Roth IRA. At the time of conversion, the IRS mandates that you prorate the conversion over all your IRAs, meaning that you cannot convert just the non-deductible amount to avoid taxes. The workaround is that if you moved everything back into a 401(k), then there are no assets to prorate and therefore the whole conversion is tax free.

I know this sounds a bit complicated, but it’s pretty straightforward once you understand all the rules. The good news is that E*TRADE actually offered a few tools to help with the conversion. From opening all the accounts to making the conversion itself, you can do everything in a self-serve online system that takes just minutes. I hate paperwork, and this was a nice surprise.

I was also relieved when I spoke with the retirement specialist at customer support because they seem to handle these conversions all the time, meaning they know how to use their system to accomplish the tasks in question. I would still need to wait three business days for the funds to be deposited into the Traditional IRA before I make the conversion, but I suspect future conversions will literally take three minutes of mouse clicking now that everything is already set up.

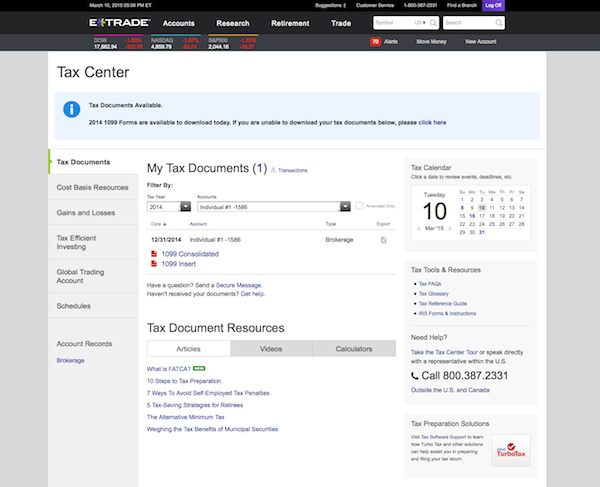

Finally, I got quite a few 1099s for all the transfers and I’m extremely relieved that none of the paperwork was botched. They even have an online Tax Center that includes educational material from tips on managing capital gains and losses to frequently asked tax questions.

A recent E*TRADE StreetWise survey found that many people knew the power of tax advantaged accounts in reducing taxes, but not everybody knows about all the tools available to them. Maybe it’s part knowledge and part motivation too. This is something we can do better here at MoneyNing.com. After all, you don’t get ahead unless you implement what you’ve learned.

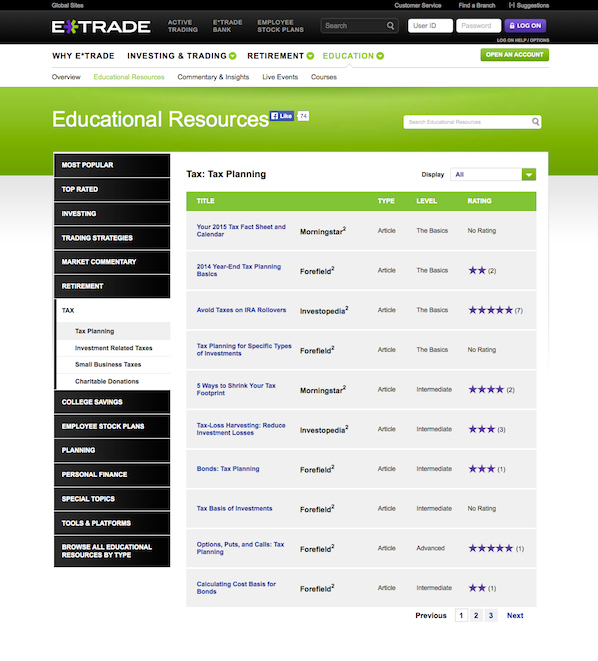

From doing research for this post, I came across the E*TRADE Education Center that offers a bunch of educational resources from cost basis reporting to tax loss harvesting. (And don’t worry, it’s accessible to the public whether you are a customer or not).

We often talk about saving money over here, but the idea extends to investing as well. By making a few changes to my Individual 401(k), I’m literally going to save thousands, if not tens of thousands, of dollars in my lifetime. Taxes are top of mind this time of the year. Do you know everything you could be doing to reduce your taxes? And if so, are you making an effort to implement all the strategies available to you?

Editor's Note: I've begun tracking my assets through Personal Capital. I'm only using the free service so far and I no longer have to log into all the different accounts just to pull the numbers. And with a single screen showing all my assets, it's much easier to figure out when I need to rebalance or where I stand on the path to financial independence.

They developed this pretty nifty 401K Fee Analyzer that will show you whether you are paying too much in fees, as well as an Investment Checkup tool to help determine whether your asset allocation fits your risk profile. The platform literally takes a few minutes to sign up and it's free to use by following this link here. For those trying to build wealth, Personal Capital is worth a look.

{ read the comments below or add one }