This post brought to you by Chase. The content and opinions expressed below are that of MoneyNing.

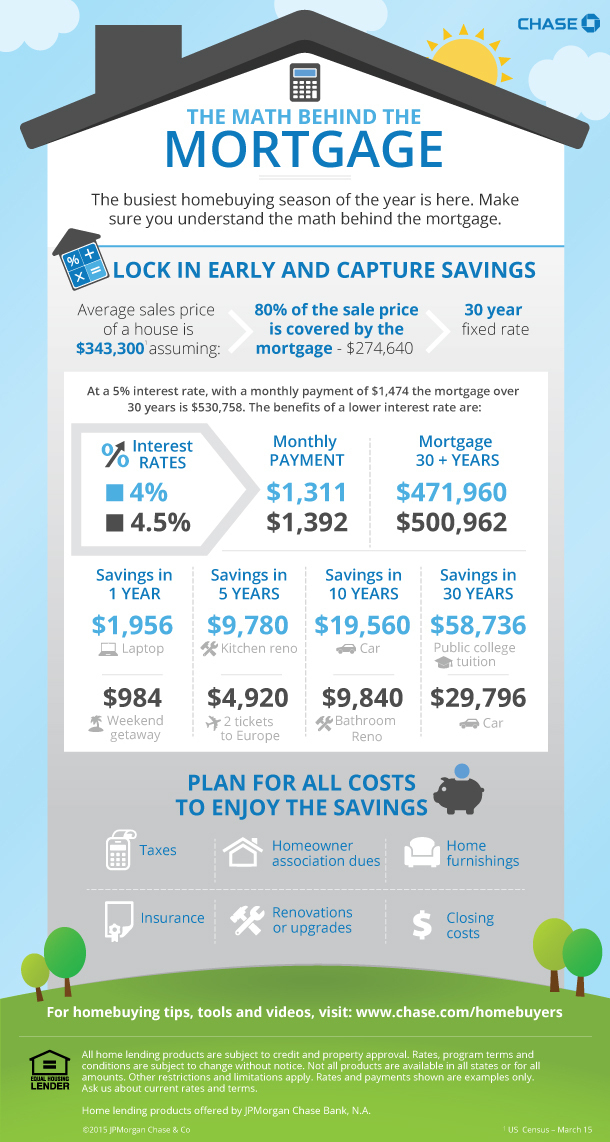

I mentioned last time how rising mortgage rates create an interesting dynamic because while the rates affect monthly payments directly, the higher cost of ownership puts downward pressure on home prices. The recent survey by Chase along with the infographic below shows the math involved, so let’s dive into the numbers today to give you a better picture of what I mean.

With interest rates topping 4% in June, many potential homebuyers I know are starting to worry because as the example above shows, a mortgage of $274,640 at 5% interest equals a $1,474 monthly payment versus $1,311 at 4% – a difference of $163 every month.

Now $163 may not sound like a crazy amount to some of you, but let me extend this example further to illustrate why homebuyers are nervous. Chase uses the average sale price of a house at $343,300 with a 20% down payment. Keeping the monthly payment the same at $1,311 only gets you a $244,300 mortgage when interest rates rise from 4% to 5%. With the same down payment of $68,660, the maximum house price you can afford will then be reduced to $312,960 instead of $343,300. And for those who can afford to pay the extra $163 a month, paying the amount for 30 years means paying nearly $60,000 more. I don’t know about you but no wonder potential homebuyers are worried.

Fortunately, reality isn’t nearly as bad as these numbers show. Real estate prices are bound by supply and demand. A higher monthly payment for the same mortgage loan amount means fewer homebuyers will be able to afford higher priced homes. This means fewer bids for each home, and that in turn will cause home sellers to lower their asking price. The exact effect will vary for each market, but affordability is definitely a factor. Just look at how lowered rates have skyrocketed home prices around the world during the past several years. A lower price doesn’t just mean a smaller price tag either, because property taxes will be lower, as does closing costs and even home owners insurance too.

Speaking of related costs, remember the mortgage is just part of the cost of buying a home. Homeowners’ association dues, insurance, closing costs, taxes and even renovations and home furnishings need to be taken into account. In the context of rising mortgage rates, this is actually good news because even though the mortgage amount can fluctuate widely based on daily changing interest rates, most of the other costs are relatively fixed. So just take a deep breath, relax, and keep a level head when you are out house hunting.

And if you are still nervous about the whole homebuying process, don’t forget to use the tools out there to help you. Chase, for instance, has a variety of tools that are available to all homebuyers including information about buying a home and a mortgage rate calculator. Visit chase.com/homebuyers for more.